will child tax credit continue in 2022

Those who did not receive monthly payments in 2021 can file a tax return to get their. To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early 2022.

How The Child Tax Credit Originated And The Future Of The Child Tax Credit Forbes Advisor

6 hours agoIn 2008 Congress passed a landmark law the Child Soldiers Prevention Act which withholds certain types of US military assistance from governments using children in their.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Continuing the expanded credit would have eased the effects of inflation on families. 5 hours agoThe enhanced child-tax credit paid eligible households up to 300 monthly per child under age 6 and up to 250 for children between the age of 6 and 17.

The existing credit of 2000 per child under age 17 was increased to 3600 per child under 6 and 3000 per child ages 6 through 17. The 2021 increased child tax credit was part of Bidens 19 trillion American Rescue Plan that went into law in March 2021. New research from the University of Michigan focuses on the effect of the 2021 Child Tax Credit on families living in poverty noting that the monthly payments reduced certain.

Under the new child tax credit provisions. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Half of the enhanced sum was made.

While advocates must continue to push for an extension work can be done now to improve access to the existing credit for those who qualify. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000 for.

For tax year 2021 the fully. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month.

This means that the credit will revert to the previous amounts. Generally this is 1800 per younger child and 1500 per older child the nonprofit explains. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child.

The maximum child tax credit amount will decrease in 2022. 2022 at 1200 pm. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400.

The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. Instead the expanded Child Tax Credit payments expired at the end of 2021. The Empire child tax credit in New.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The 2021 Child Tax Credit Implications For Health Health Affairs

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Will Child Tax Credit Payments Be Extended In 2022 Money

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

How To Get Child Tax Credit And Stimulus Check For New Baby Born In 2021 In Taxslayer Youtube

Child Tax Credit 2022 How Much Will You Get

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

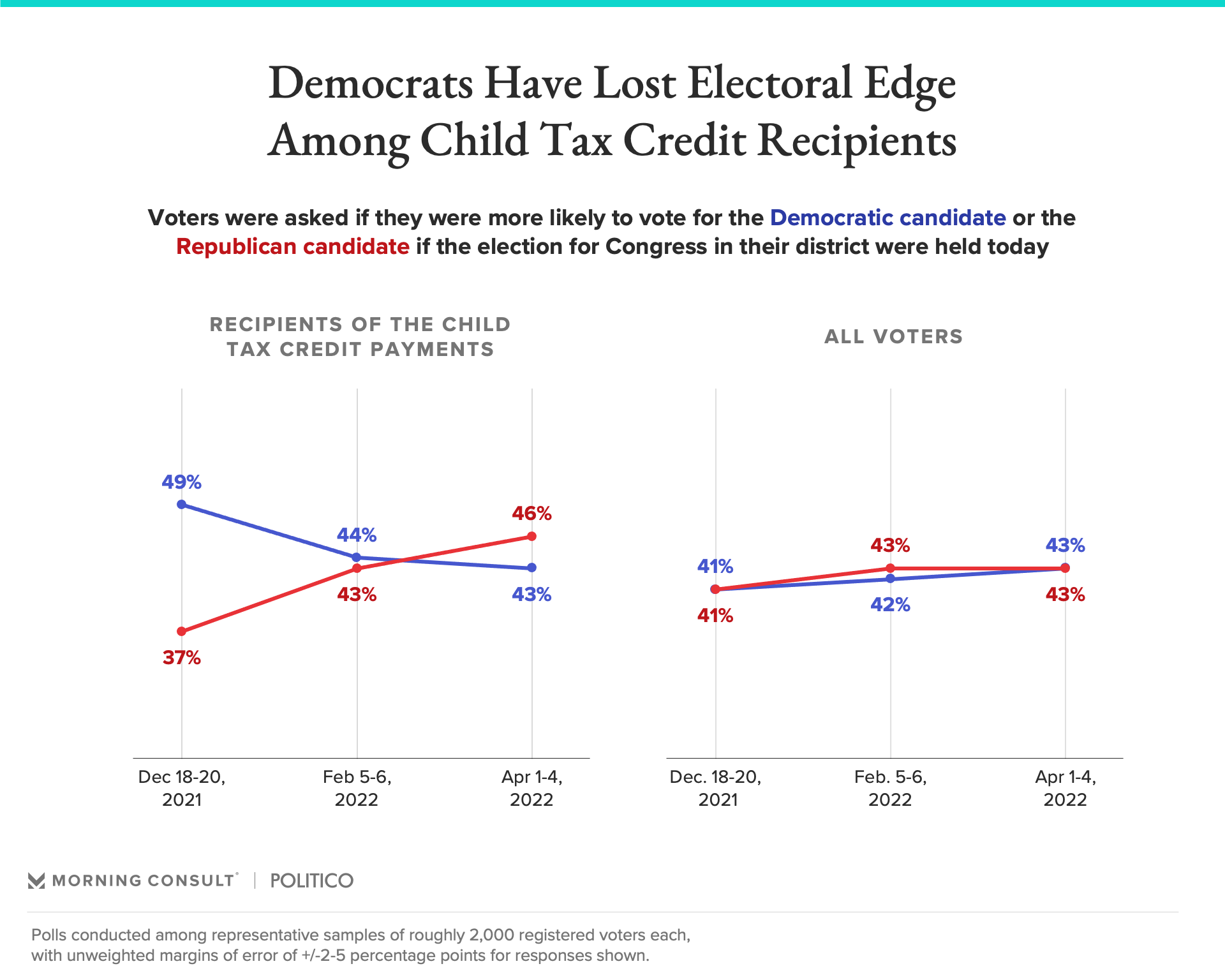

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Stimulus Update Final Child Tax Credit Payment Of The Year Arrives In 1 Week

Stimulus Update Will Child Tax Credit Monthly Payments Restart Al Com

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 Al Com

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Where S My Child Tax Credit Coalition On Human Needs

Child Tax Credit Will Monthly Payments Continue Next Year Al Com